What is Transfer Pricing?

Transfer pricing analyses the transactions between controlled companies, where the price for controlled transactions has to be similar to uncontrolled transactions.

In other words, a company must charge a similar price for controlled transactions (between a subsidiary, an affiliate, or commonly controlled companies that are part of the same larger enterprise) as an uncontrolled transaction made by a third party. The amount must be a fair market price. Examples of such transactions are the provision of management services, the supply of goods, and the provision of loans.

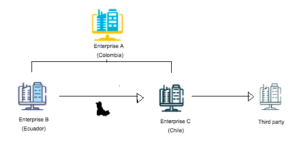

In this case, Enterprise B manufactures boots, and Enterprise C distributes them. Both B and C are under the Enterprise A umbrella; B and C are 100% owned by Enterprise A. This means they are all associated enterprises.

Enterprise A has no control over the price at which a pair of boots is sold when selling them on the market because prices are set by supply and demand. However, A does control any transactions between B and C, which is called a controlled transaction. The price charged for this transaction is what is called a “transfer price.”

Having this in mind, now, why Transfer pricing is relevant?

The price at which a pair of boots is sold by B to C affects their individual financial results. If B charges a high price, B makes more profit. If B charges a low price, C makes more profit.

For Enterprise A, isn’t relevant which of the two companies makes the profit, because the financial results of B and C are consolidated. Thought, it does matter from a tax perspective.

Why? because taxations vary from country to country. The corporate tax rate is different depending on the country. Parent companies (in this case A), want to see as much profit after tax as possible.

Meaning, by charging above or below the market price, enterprises can use Transfer Pricing to transfer profits and costs to other divisions internally to reduce their tax burden. Tax authorities have strict rules regarding transfer pricing to attempt to prevent companies from using it to avoid taxes.

The goal

To prevent multinationals to report too much taxes in high-tax countries and too little in low-tax countries. As well as ensure that profits are taxed at the place where value is actually created.

In other words, the controlled transaction does have to satisfy the Arm’s Length Principle.

The Arm’s Length Principle

In a controlled transaction, associated enterprises (entities that are related via management, control, or capital) should agree on the same terms and conditions as the ones agreed upon between third parties in an uncontrolled transaction.

Examples

Intangibles

When transferring intangible assets to a low-tax country, this is the same as cutting tax bills, which means: there’s a Transfer Pricing issue. If the Tax Authority finds this out, a Transfer Pricing case would be open and the company has to go to trial. If the Tax Authority wins the case, the company may be required to pay a certain amount of money in addition to interest and penalties.

TP Guidelines – OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations

In order for TP to accomplish its goal, the OECD wrote guidelines to ensure the best practices.

It’s important to understand that TP is not black and white. Even though there are 9 chapters that describe the “TP skeleton”, each transaction is different. I’m going to give a brief explanation of the TP Methods, but I encourage you to read the entire guidelines.

Chapter 1: The Arm’s Length Principle

Chapter 2: Transfer Pricing Methods

–> How to choose the best method for the analysis?

> the first step is to understand what’s the nature of the controlled transaction, which is determined through a functional analysis

> Reliable information

> Degree of comparability (adjustments that may be needed to eliminate material differences)

–> Comparability factors: the characteristics of the property or service; contractual terms; functional analysis; economic circumstances and business strategies.

–> The OECD says that the traditional transaction methods are the most direct because if there is any difference in the price of the controlled transaction from the price to the uncontrolled transaction, it can be traced directly to the commercial and financial relations made between the enterprises.

> Comparable Uncontrolled Price Method (CUP) – compares the price charged for products and services transfer in a comparable controlled transaction to the price transferred in a comparable uncontrolled transaction.

If there’s a difference in the conditions, those can’t affect the open market; a reasonable adjustment can be done (comparability factors)

> The resale Price Method (RPM) – the price at which a product that has been purchased from a related party is resold to an independent company. This resale price is then reduced by a gross margin, resulting in the resale price margin.

> Cost plus method (CPLM) – It compares the costs incurred for property or services in a controlled transaction transferred or provided to an associated purchased. Then an appropriate mark up is added to the cost, to an appropriate profit.

–> In cases where each of the parties makes unique and valuable contributions in the control transaction, it’s advisable to use a transactional profit method.

>> Transactional Net Margin Method (TNMM) – examines a net profit indicator in an appropriate base (costs, sales, assets)

> Net cost plus margin –> return of the total cost of the company

> Net resale price –> measures the return on sales of a company

>> The transactional profit split method – analyzes the terms and conditions of the transaction to determine the division of profits that 3rd parties would have charge.

> The contribution profit split method –> splits profits depending on functions and risks assumed, and the assets that each entity contributes.

> Residual profit split method –> it takes the routine profit for an entity, then the remaining profit is then split based on each party’s contribution.

Chapter 3: Comparability Analysis

Chapter 4: Administrative Approaches to avoiding and resolving TP disputes

Chapter 5: Documentation

Chapter 6: Special considerations for intangibles

Chapter 7: Special considerations for Intra-groups services

Chapter 8: Cost contribution arrangements

Chapter 9: TP aspects of business restructuring

Are the OECD Guidelines applicable worldwide? Some countries decided to implement their guidelines, such as the U.S. In the US, transfer pricing regulations are primarily governed by Section 482 of the Internal Revenue Code (IRC).

This provision authorizes the IRS to allocate income, deductions, credits, or allowances among related businesses to ensure that transactions accurately reflect income and prevent tax avoidance. At the heart of the U.S. approach is the arm’s length principle, which requires that transactions between related entities be priced as though they were conducted between independent, unrelated parties under comparable circumstances. very similar to the OECD Guidelines, right?

Here are some differences and similarities between the OECD and the U.S. Guidlines:

Key Differences and Similarities

Both U.S. transfer pricing regulations and the OECD guidelines are built on the arm’s length principle, but they diverge in emphasis and implementation:

1. Documentation

-

OECD: Recommends a three-tiered documentation approach—Master File, Local File, and Country-by-Country (CbC) Reporting.

-

U.S.: Documentation is not explicitly required, but penalty rules and international standards make it effectively mandatory. The U.S. does not adopt the Master File/Local File framework, though it does require CbC reporting for large multinational groups (with revenues above €750 million). If requested, documentation must be submitted within 30 days.

2. Methods and Approach

-

OECD: Provides a hierarchical framework, prioritizing traditional transaction methods but allowing profit-based methods when appropriate.

-

U.S.: Uses the “best method rule,” which requires selecting the method that produces the most reliable arm’s length result, considering factors like comparability and data quality.

3. Enforcement and Penalties

-

OECD: Offers mechanisms for dispute resolution and minimizing double taxation.

-

U.S.: Imposes strict penalties for non-compliance, including income adjustments and penalties of 20% or 40% for substantial or gross valuation misstatements.

4. Safe Harbor Rules

-

OECD: Recently introduced (2024) Amount B, a simplified approach to determine returns for baseline marketing and distribution activities involving tangible goods.

-

U.S.: Provides certain safe harbors, typically in areas such as intercompany services and interest on loans.

Summary

Although the U.S. does not formally adopt the OECD guidelines, both systems are grounded in the arm’s length principle and often lead to similar outcomes. The OECD framework serves as the global reference point, while the U.S. maintains its own statutory rules under IRC Section 482.